If Lawsuits, Debt, or a License

Revocation Are Threatening Your

Business, We Need to Talk.

What might look like the end could be the start of a prosperous new future.

Call now to schedule a free consultation with an experienced attorney: 619.202.7511, Ext. 1.

If Lawsuits, Debt, or a License Revocation Are Threatening Your Business, We Need to Talk.

What might look like the end could be the start of a prosperous new future.

- Reducing or even wiping out your SBA-EIDL loans.

- Eliminating your personal guarantees.

- Stopping your lawsuits.

- Reducing or even wiping-out your unsecured debt.

- Repaying only what your equipment is worth.

- Maintaining your key vendor relationships.

- Rejecting your unprofitable contracts and/or leases.

Is your business facing financial uncertainties? Unlock its full potential profitability by addressing debts strategically.

Connect with our experienced legal team for a free consultation, and let's chart a path to financial resilience together.

~Meet Our Lead Attorney~

With over 34 years of experience and a track record of successfully handling over 2,200 cases, Steven Cowen and his team possess the expertise needed to guide your business to profitability.

As the lead attorney at Debt Solution Law Group, Steven Cowen has made a name for himself in the world of business reorganization, business restructuring and business debt elimination. He is one of the few true experts on the Small Business Reorganization Act and its business saving properties. Attorney Cowen has observed the damage done to businesses by the pandemic and has made himself available to all California business owners and operators who are looking to save their businesses and/or increase the profits they take home each month.

Do You Have More Questions?

Our frequently asked questions page contains more information. A link to our frequently asked questions page is below.

Ready to Get Started?

Give us a call or leave your information on our contact form. We have knowledgeable staff standing by to assist you.

Our Firm Has Over 125 Five-Star Reviews on Google And a 4.9/5 Rating!

See what our clients have to say about our firm:

Our Firm Has Over 125 Five-Star Reviews on Google and a 4.9/5 Rating!

See what our clients have to say about our firm:

Do You Have More Questions?

Our frequently asked questions page contains more information. A link to our frequently asked questions page is below.

Ready to Get Started?

Give us a call or leave your information on our contact form. We have knowledgeable staff standing by to assist you.

-Service Area-

We Serve Business Owners Statewide in California.

Wherever you’re running your business in California, we’ve got your back. Our team is here to make legal support straightforward and accessible. If you’re facing debt challenges or considering restructuring, count on us to be your practical partners. Your success is our priority, no matter where you are in the Golden State – because every business deserves a clear path to thrive.

-Service Area-

We Serve Business Owners Statewide in California.

Wherever you’re running your business in California, we’ve got your back. Our team is here to make legal support straightforward and accessible. If you’re facing debt challenges or considering restructuring, count on us to be your practical partners. Your success is our priority, no matter where you are in the Golden State – because every business deserves a clear path to thrive.

Personal guarantees can be eliminated.

The repayment of almost all business debt is personally guaranteed by one or more of the business’ owners. Wiping out business debt will not mean much if the creditor can get paid from the wages or property of the personal guarantor. The key is knowing how to use recent changes to California law to “take the bite out of” the personal guarantees.

The key is the Small Business Reorganization Act (the "SBRA").

For many California businesses, post-pandemic income is down, sometimes way down, and business debt is higher because of the loans needed to stay afloat. If reducing or eliminating business debt can make you profitable again, we need to talk. The Small Business Reorganization Act can end the downward spiral –purchase contracts written down to the value of the equipment purchased. Wipe out credit card and other unsecured debt. Reject unproductive leases. Pay back taxes over time.

Payment plans available.

To avoid the financial ruin that personal guarantees or a failed business can cause is surprisingly affordable. The down payment is negotiable. The balance of the fees and costs are paid, typically, over 12 to 36 months. The attorney’s fees and costs are always a fraction of the money saved. The issue really boils down to whether the personal guarantees can be wiped out, the business saved, or both. Call now or use our convenient contact form and a knowledgeable member of our team will get right back to you.

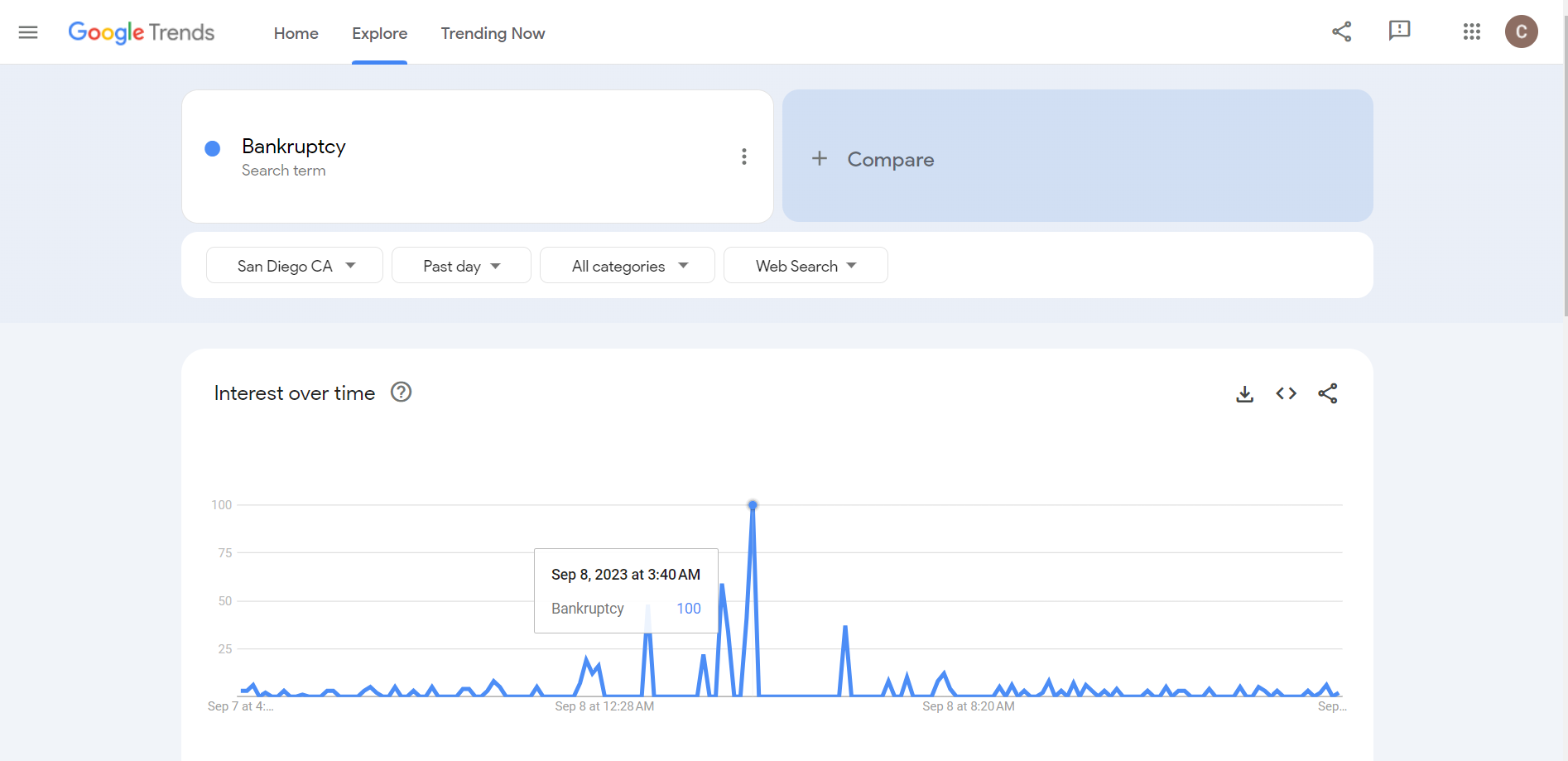

Put an End to "Doom Scrolling."

According to Google Trends, Interest in Debt Restructuring and Bankruptcy Peaks at 3:40 AM Daily.

Late-night anxieties about debt haunt many business owners. The data shows that sleepless nights are often spent grappling with the financial strain that debt brings. Our service offers practical relief, guiding businesses through restructuring with a straightforward approach. We provide solutions to ease the burden, helping you regain control of your financial future. Our goal is to turn those restless nights into a confident path forward, ensuring that your business not only survives but thrives.

Put an End to "Doom Scrolling."

According to Google Trends, Interest in Debt Restructuring and Bankruptcy Peaks at 3:40 AM Daily.

Late-night anxieties about debt haunt many business owners. The data shows that sleepless nights are often spent grappling with the financial strain that debt brings. Our service offers practical relief, guiding businesses through restructuring with a straightforward approach. We provide solutions to ease the burden, helping you regain control of your financial future. Our goal is to turn those restless nights into a confident path forward, ensuring that your business not only survives but thrives.